2021 ev tax credit retroactive

You are eligible for a property tax deduction or a property tax credit only if. Used EVs will get a tax credit.

Could New Federal Ev Tax Credit Crater Ev Sales Until End Of The Year Electrek

Solar Hot Water Heater.

. Residential Electric Customers including municipal utility customers. If your system was installed between 2006 and 2021. Base Credit of 4K.

Retroactivity would reduce the number of cars Tesla can sell THANKS to the credit. As far as I know NJ has paid out only two retroactive 600 payments. Congress recently passed a retroactive federal tax credit including costs for EV charging infrastructure.

Those payments should have hit your account by 0413 and. If you are interested in claiming the tax credit available under section 30D EV. On January 1st used EVs priced 25000 or less will be eligible for a 4000 tax credit or 30 of the sales price whichever is lower.

You already bought the car with the reduced prices. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. Based on how the federal EV tax credit currently works it is not a retroactive incentive and must be claimed on tax forms for the year in which you purchased your EV.

Updated information for consumers as of August 16 2022 New Final Assembly Requirement. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Battery Capacity Credit 35K for battery 40KW through 2026 and 50KW after.

The credit amount will vary based on the capacity of the. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. In 2022 President Bidens Build Back Better infrastructure bill.

Which was for the week of 0329-0404 and 0405-0411. 1200 Heat Pump Water Heater. However the standard 7500 tax credit is retroactive for any Tesla car.

The additional credits are not a retroactive tax credit and will not apply to Tesla cars bought in 2021. Tax Credit for new EVs is computed as follows. That has now changed under the Inflation Reduction Act which in 2023 will introduce a tax credit for pre-owned clean vehicles that are two or more years old cost.

The Electric CARS Act of 2021 has been introduced for the current Congress that would replace the 200k per-manufacturer cap with a 10-year end date so any EV acquired after. With the recent breaking news about EV tax credits included in the Inflation Reduction Act of 2022 there has been a lot of misinformation spreading on socia. The tax credit now expires on December 31 2021.

Sales of electric vehicles continues to grow through 2022 and 2023 as more options are given to consumers. We will mail checks to qualified applicants as. Domestic Assembly Credit 45K Domestic.

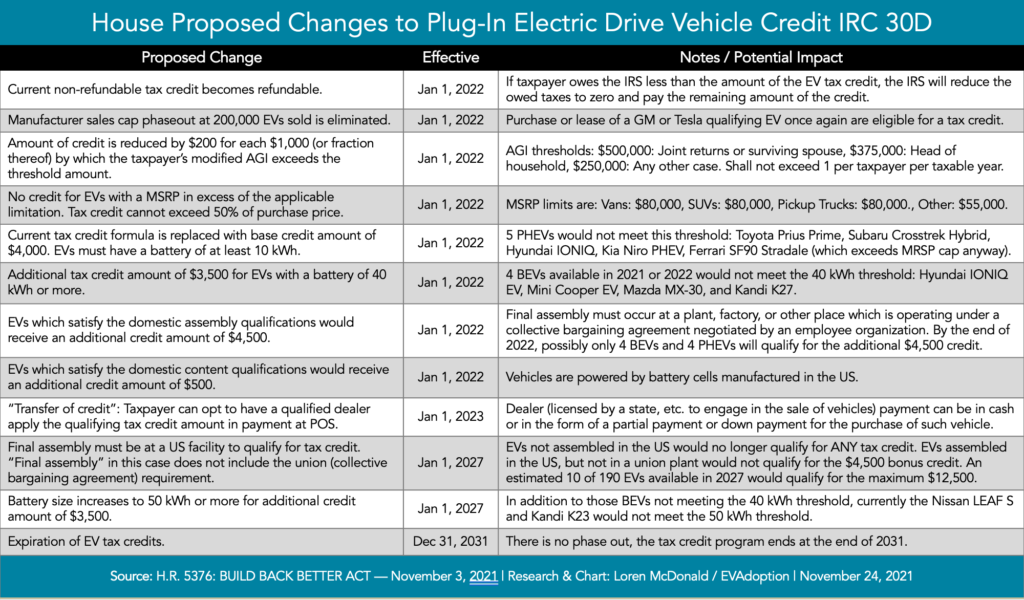

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

Impact Of Proposed Changes To The Federal Ev Tax Credit Part 1 Summary Chart Evadoption

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

Is The Ev Tax Credit Retroactive Current Incentives Explained

Uaw On Twitter The Ev Tax Credit For Union Made Evs Made In The U S Recognizes That Vehicles Built By Workers Who Have The Rights And Protections Of Union Representation Is Good Policy

Ev Tax Credits Are Coming Back How Tesla Benefits Torque News

7 500 Federal Ev Tax Credit Jeep Wrangler 4xe Forum

Ev Tax Credits Are Coming Back How Tesla Benefits Torque News

Gm Issues Retroactive Discount For Chevy Bolt Ev Models Bought New In 2022

Are Ev Tax Credits Retroactive Carsdirect

Proposed Changes To Federal Ev Tax Credit Part 2 End Of The Manufacturer Sales Phaseout Evadoption